Anticipation for this years Roots and Blues festival is heating up!

Since 1992 the Roots and Blues festival has drawn in performers and fans from around the world. This festival first started out as a small indoor festival, the result of the Shuswap Coffeehouse movement of the 1970s and ‘80s. From these roots grew the not-for-profit Salmon Arm Folk Music Society and an event that has something for everyone.

The festival features the Family Fun Zone, packed with activities to keep everyone in the family happy – face-painting, crafts, water balloons, sandboxes, and bouncy houses; a plethora of vendors; and over five different stages to choose from!

Salmon Arm Roots and Blues Festival lineup this year is proving to be one of the most anticipated; from the sounds of Five Alarm Funk, Blue Rodeo, and Sarah McLachlan.

Roots and Blues will roll out August 18-20, you don’t want to miss this!

Sources: Salmon Arm Observer

Farm stands and farmer’s markets are a popular experience and a driver for agritourism in the Shuswap.

Building community around food by supporting local food security initiatives is key to keeping our local farms and businesses around.

“The Downtown Salmon Arm Farmers’ Market is entering its sixth season in its location at the 300 block of Ross Street near Hudson Avenue. With a mandate to build community around food, this rain-or-shine market features eight vegetable and produce vendors, with a total of up to 50 vendors at full capacity.

With a fountain and stage nearby, live music and entertainment, as well as kids’ activities, are often organized onsite. Curb side pickup for orders placed through the market’s online store is also available.”

There is also an all organic market on Wednesday’s at the uptown Askew’s in Salmon Arm, and farmer’s markets in surrounding areas such as Sorrento, Sicamous, Scotch Creek, and Enderby.

“Agriculture is a huge asset in the Shuswap with over 600 large and small-scale producers. As the agricultural offerings of the Silver Creek, Yankee Flats and Falkland areas are being given a spotlight for a pilot project being planned by the regional district, we can hope that agritourism continues to expand the tourism in the Shuswap as a four-season destination”

Don’t miss out on the fun and delicious treats of the Shuswap!

Sources: Salmon Arm Observer and BC Farmer’s Market Trail

https://bcfarmersmarkettrail.com/market/downtown-salmon-arm-market-2/

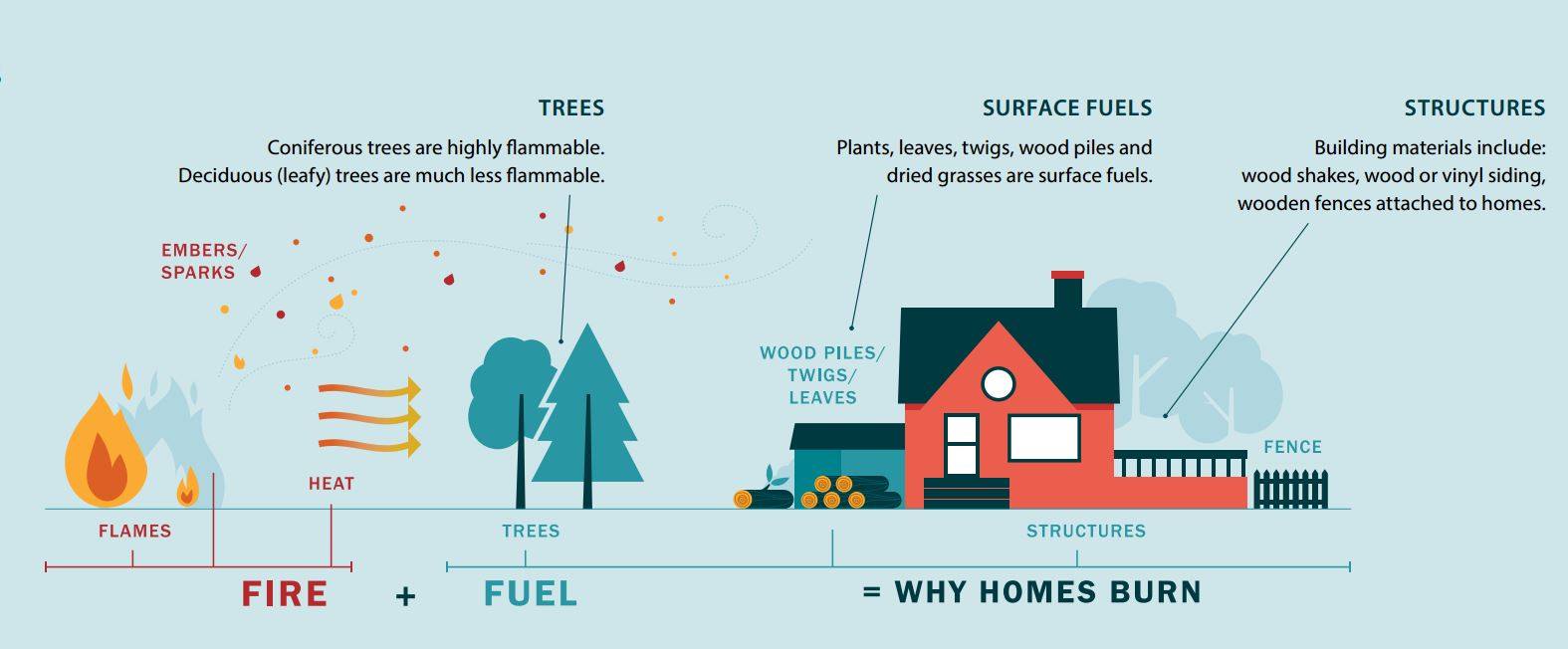

“Did you know?

- Nearly half of all wildfires in B.C. are caused by people. (FireSmart BC)

- More than 50% of homes destroyed by wildfire are ignited by embers blown by the wind. (BC Wildfire Service)

- 80-90% of FireSmart homes with non-combustible roofs & 10 metres of clearance will survive a major wildfire. (Canadian Institute of Forestry)

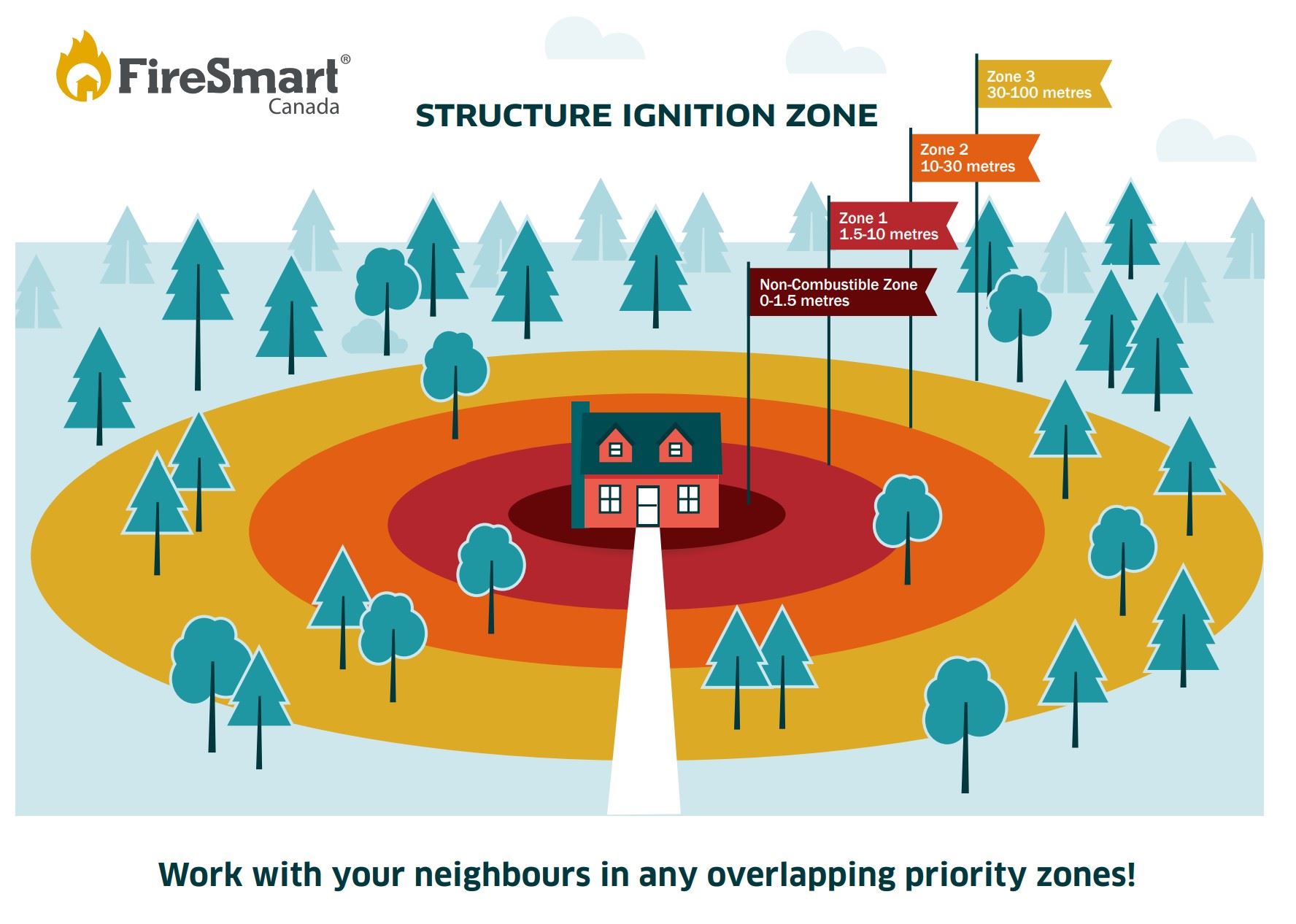

Individual homeowners and communities can take simple steps to reduce the impact of wildfire. The time to reduce the threat of wildfire is now, not when a fire is at your doorstep. Be proactive, be practical, and be FireSmart.

Adopting FireSmart principles to your home and property can help reduce the potential impact of wildfires and will help firefighters better defend your property.

What the City of Salmon Arm is doing:

The City of Salmon Arm is taking action to reduce the risk and impact of wildfire to our community. As we live in a rural area surrounded by forested crown tenure, strategies are needed for private, agricultural, city-owned and crown lands.

- 2019: A Community Wildfire Prevention Plan (CWPP) was developed to prioritize initiatives – FireSmart education for residents started – an instructional clearing project near Little Mountain tennis courts was completed and fuel load mitigation targeting fir beetle infestation was begun.

- 2020: Fuel load mitigation of prioritized areas will be increased (Little Mountain and South Canoe) – FireSmart education for residents will be expanded – selection and training for two Salmon Arm neighbourhoods to be recognized as being FireSmart.

What residents can do:

Homeowners are encouraged to look ahead to the next wildfire season and keep FireSmart best practices in mind during spring and fall yard maintenance.”

“These FireSmart Homeowner resources are great for better protection of your home and property.

- Download the FireSmart Homeowner’s Manual (pdf);

- Download the FireSmart Begins at Home Assessment (pdf); and

- Download the FireSmart Guide to Landscaping (pdf).

Check out:

- Salmon Arm Fire Department on Facebook;

- FireSmart in the CSRD; and

- Follow the City of Salmon Arm on Facebook.

You and your neighbours have a role to play in reducing the wildfire threat to your home. Changes made to the area closest to your home and your home itself have the greatest impact on reducing the risk of wildfire damage. Follow these tips, and others found in the FireSmart Guide, to help protect your home:

- Remove all combustibles within the first 10 metres around your home;

- Space coniferous trees 3 metres apart;

- Prune coniferous tree branches within 2 metres off the ground;

- Plant low-density, fire-resistant plants and shrubs with moist, supple leaves;

- Remove all dead vegetation and clean up your yard regularly;

- Integrate FireSmart best practices into your short and long-term renovation projects.

Listen to Councillor Lavery’s radio interview.”

Sources: City of Salmon Arm

https://www.salmonarm.ca/429/Fire-Smart

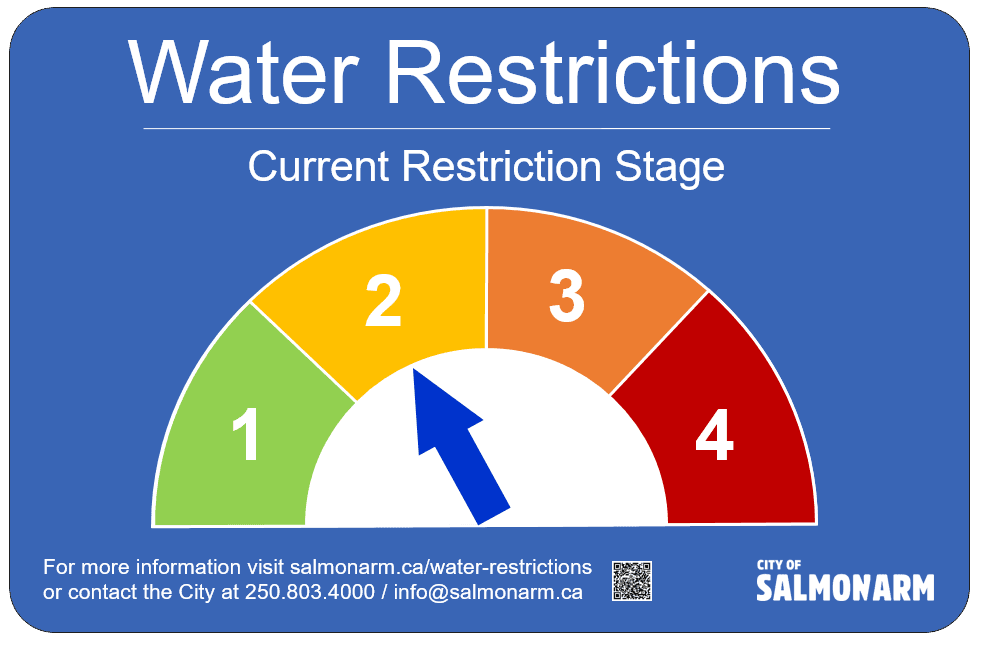

Current Restriction: Stage 2 – Effective July 12, 2023

“To better manage water demand and ensure sufficient supply during summer months and more severe drought conditions, the City of Salmon Arm has implemented a multi-stage restriction strategy for outdoor water use. These restrictions apply to all properties in Salmon Arm (residential, commercial, industrial, institutional, farm, etc.) that use the City water supply.

Stage 1 is in effect year-round. Restrictions will be increased to Stages 2, 3 and 4 depending on environmental conditions, water supply system capacity and demand on the system. Residents will be notified of the stage changes via sign boards, newspaper, radio, social media, City website and other means available. Use Notify Me to set-up email and/or text alerts for water restriction stage changes under the Alert Center section.

The regulations permit outdoor water use on designated days of the week depending on the last two numbers of the street address and the current restriction stage as follows:

| Water Use Schedule * | Stage 1 (3 days/week) | Stage 2 (2 days/week) | Stage 3 (1 day/week) | Stage 4 (Not permitted) |

|---|---|---|---|---|

| Group A (00 – 33) | Sun, Tue, Fri | Tue, Fri | Tue | – |

| Group B (34 – 66) | Mon, Wed, Sat | Wed, Sat | Sat | – |

| Group C (67 – 99) | Sun, Tue, Thurs | Sun, Thurs | Thurs | – |

* Numbers in parenthesis are the last 2 digits of the street address. Stratas and mobile home parks (MHP) are to use the street address, not the unit address (I.E. the entire strata or MHP will share watering days).

On designated days, outdoor water use is allowed for a MAXIMUM OF 2 HOURS in ONLY ONE of the following time periods:

- 7 AM – 11 AM

- 7 PM – 11 PM

- 12 AM – 7 AM (this is the preferred time period for automatic sprinkler systems)

These periods provide flexibility but the best watering time is overnight or early morning, to maximize absorption and minimize evaporation.

View the detailed water usage restrictions sheet (pdf) for the types of water use permitted for each restriction stage and watch for these water restriction signs posted around the City.

NOTE: Properties over 1/2 acre (0.2 hectares) in size are not permitted to irrigate with City water. This includes properties with farm status.

Failure to comply with these restrictions may result in a fine, metered water rates, or a discontinuation of service.

For or any other questions or to report an infraction please contact City Hall at 250.803.4000 or email [email protected]

Visit our Water Conservation page for information on how to conserve water.

Pertinent bylaws:

- Bylaw 1274 – Water Rates and Waterworks Regulation (pdf)

- Bylaw 2760 – Ticket Information Utilization (pdf) (refer to Schedule 10 for fines associated with sprinkling infractions)”

Sources: City of Salmon Arm

https://www.salmonarm.ca/water-restrictions

“Packed with information and ideas to begin understanding the impact of award-winning design and building techniques, be sure to check out Design Build Trends and discover how designing with purpose and building above code can enhance the livability of your home.

Award-winning industry leaders Joe Geluch of Naikoon Contracting, and Khang Nguyen of Architrix Design Studio believe in designing with purpose and building above the basic code to improve the livability of our homes to improve the wellness of our families.

‘We’re certainly seeing consolidation. Families consolidating incomes and capital to buy a property, to build a triplex or a duplex with a suite for mom. And so, the size of things is trending down. The 4,500 square foot home was pretty classic years back. And now we’re seeing people with the ability to build that size of a home but saying, ‘Hey, you know what, we only need 3,200 square feet. Let’s maximize our dollar in quality and not quantity, ’ said Joe Geluch of Naikoon Contracting.

Listen in as Mike and Jennifer-Lee of Measure Twice, Cut Once get the scoop on the latest industry trends.

‘I try to keep things as simple as possible. I try not to travel too far to get to work. I try not to complicate the decisions I make. And I think that comes through in how I design and how I guide clients. So, the path of least resistance is kind of where I like to focus,’ says Khang Nguyen, Architrix Design Studio.

You will find “Measure Twice, Cut Once” podcasts on iTunes, Spotify and Google podcasts.”

Sources: Salmon Arm Observer

Salmon Arm percentage increase one of highest in Thompson Okanagan, Sicamous one of lowest

Shuswap residents will likely see an increase in the value of their homes when the BC Assessments arrive early this year.

According to BC Assessment, a single-family residential property in Salmon Arm was worth $573,000 on July 1, 2021, and is now worth $668,000 as of July 1, 2022. This is a 17 per cent increase, and there are five geographical areas in the Thompson Okanagan assessment region that have a higher percentage jump. These include Barriere, Clearwater, Chase, Clinton and Sun Peaks.

Sicamous homes, however, come in at one of the lowest percentage hikes – nine per cent. A Sicamous home worth $449,000 in 2021 was assessed at $492,000 on July 1, 2022.

A Tappen home made the BC Assessment Top 100 Valued Residential Properties list at number 45, valued at $8.6 million ($8,594,000). It is categorized as an acreage and not a single-family residence.

“Homeowners throughout the Okanagan can generally expect to receive assessments that are up about 10 per cent to 15 per cent for houses while condos and townhomes are up a bit higher,” said Okanagan Deputy Assessor Tracy Wall. “Assessments are valued as of July 1, meaning everyone’s annual assessment is a reflection of what your home could have sold for around that time.”

The Thompson Okanagan area has 288,903 properties that were assessed, and the total value of real estate in the area is $234 billion.

“It is important to understand that increases in property assessments do not automatically translate into a corresponding increase in property taxes,” said Thompson area assessor Tracy Shymko. “As noted on your Assessment Notice, how your assessment changes relative to the average change in your community is what may affect your property taxes.”

Property owners with questions or concerns about their assessment can contact BC Assessment toll-free at 1-866-825-8322 or online at bcassessment.ca. Hours of operation are 8:30 a.m. to 5 p.m., Monday to Friday in January.

Sources: Salmon Arm Observer

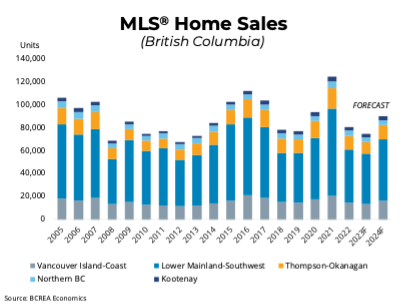

Multiple Listing Service®(MLS®) residential sales in BC are forecast to decline 6.6 per cent to 75,530 units this year. In 2024, MLS® residential sales are forecast to post a strong rebound, rising 19.3 per cent to 90,100 units.

“An uptick in home sales to start the spring, despite still high mortgage rates, indicates how much pent-up demand there is in the market waiting to be unlocked,” said BCREA Chief Economist Brendon Ogmundson. “With the Bank of Canada on hold and fixed mortgage rates still stubbornly high, home sales are unlikely to fully normalize this year.”

While home sales remain close to 25 per cent below normal, the inventory of homes for sale has not accumulated significantly as potential sellers have held off on listing their homes in a down market. While significant uncertainty surrounds the economic outlook, the current market shows no signs of financial vulnerability or highly motivated sellers. As sales recover into a low inventory market, prices will likely begin to rise month-over-month and finish the year higher than at the start. However, on an annual basis, average prices are still expected to be down about 6.1 per cent from a record high in 2022.

Sources: British Columbia Real Estate Association

- https://www.bcrea.bc.ca/economics/housing-forecast/

- https://www.bcrea.bc.ca/wp-content/uploads/2023-05-02-forecast.pdf

Sixty per cent of Canadian housing markets anticipated to be balanced in 2023

RE/MAX Canada expects average residential prices to decrease by 3.3 per cent in 2023

- The biggest price declines across the country are expected in Ontario and Western Canada, where some markets may see average residential sale prices decrease by 10 to 15 per cent

- Price growth outlooks are anticipated in Atlantic Canada markets, with average residential sale prices expected to increase by eight per cent in Halifax and four per cent in St. John’s in 2023

- 60 per cent of regions in Canada are expected to be balanced markets in 2023, according to RE/MAX brokers and agents

- 73 per cent of Canadians still say that home ownership is the best long-term investment they can make

According to a Leger survey commissioned by RE/MAX as part of the report, Canadians view home ownership as the best long-term investment they can make (73 per cent). Yet, the majority (67 per cent), are feeling less optimistic in the short-term with 67 per cent less inclined to buy in the first half of 2023, and 62 per cent less inclined to sell in that time frame.

“It’s good see the majority of markets moving toward more balanced conditions, which is typically defined by 45 to 90 days on market. This is a much-needed adjustment from the unsustainable price increases and demand we saw early in 2022,” says Christopher Alexander, President, RE/MAX Canada. “Many Canadians have understandably expressed hesitancy about engaging in the real estate market early in 2023, in the wake of rising interest rates and broader economic uncertainties. However, despite this, a greater number of Canadians consider real estate to be a solid long-term investment compared to this time last year. As we head into the new year, it’s important that governments work collaboratively to support housing affordability and address the supply challenges that Canadians continue to face, in order to make home ownership feasible for those who want it.”

“We’re confident that as economic conditions improve and the market continues to even out into Q3/Q4 2023, a more-regular pace of activity will resume. It’s especially critical during challenging economic times, that staying informed and working with an experienced real estate professional can help Canadians clarify some of the unknowns, help them find a home within their means, and ultimately make the best decision possible,” says Elton Ash, Executive Vice President, RE/MAX Canada.

Regional Canadian Housing Market Insights

RE/MAX brokers and agents in Canada were asked to provide an analysis of their local market in 2022 and share their estimated outlook for 2023. Based on their insights, 60 per cent of housing markets in Canada are expected to be balanced markets in 2023, impacted by modest price declines and less activity.

With the exception of Halifax, NS, Ottawa, ON and the region of Montreal, QC, balanced market conditions are expected in Canada’s major city centres, including the Greater Toronto Area (GTA), ON, Mississauga, ON, Greater Vancouver Area (GVA), BC, Calgary, AB, Regina, SK and Winnipeg, MB, in what is being called a healthy development. Move-up and move-over buyers are driving activity in these regions with the exception of Ottawa, ON and Calgary, AB, where first-time buyers are expected to lead. Following a two-year frenzy fuelled by the pandemic, average residential sale prices are anticipated to decrease in Canada’s priciest markets – the GVA and GTA.

Greater Toronto Area (GTA), Ontario

The Greater Toronto Area (GTA) is currently a balanced market – a condition that is anticipated to continue into 2023. Move-up and move-over buyers have been driving demand in the region, in a trend that is expected to carry on in the next year. Meanwhile, single-detached homes remain the dominant housing type, followed by condo apartments. The average residential sale price has increased by 11 per cent from $1,086,155 in 2021 (January-December) to $1,203,916 (January-October) in 2022. The most desirable neighbourhoods in the city are currently based on location and affordability, with access to transit being the largest factor.

Rising interest rates are expected to be a dominant theme in 2023, resulting in a slower market for both buyers and sellers in the GTA. These conditions are impacting first-time buyers in particular, with many choosing to pause their home-buying efforts, due to a lack of affordability. Meanwhile, new construction projects are being delayed as a result of the widening gap between market prices and construction costs, including the impact that higher interest rates have had on financing these projects. The luxury market in Toronto has slowed down and will likely continue to cool in 2023 due to economic pressures. The average residential sale price in the GTA may decrease by up to11.8 per cent in 2023.

“This moderating market is an opportunity for homebuyers to take the time to consider their needs, assess opportunities patiently and ultimately make a wise purchasing decision and investment in the long run” adds Alexander.

Greater Vancouver Area (GVA), British Columbia

Balanced market conditions in the GVA are anticipated to continue into at least the second quarter of 2023. Move-up and move-over buyers have led consumer demand in the region, with first-time buyers following close behind – a trend that’s likely to persist into the beginning of next year.

Single-detached homes remain the dominant housing type in the area, with the “upsizing” trend expected to become increasingly popular among families in 2023. Desirable neighbourhoods in the city are currently based on location, with access to rapid transit playing a large part in purchasing decisions. A continued drop in condo pricing is expected into 2023, while the luxury market is anticipated to have a slow start to the year before balancing out in the latter half of 2023. The average residential sale price in the GVA is anticipated to decrease by five per cent in 2023.

Calgary, Alberta

Much like Vancouver, Calgary’s marked is balanced, but is expected to shift into seller’s territory in early 2023. First-time buyers are driving demand in the region, with move-up and move-over buyers trailing close behind – a trend that is expected to continue into 2023.

The average residential sale price increased by 13 per cent from $585,025 in 2021 (January-December) to $658,277 in 2022 (January-October). Condos are currently the dominant housing type in the region, with single-detached homes expected to drive the majority of sales in 2023, as buyers seek additional living space. Inventory is anticipated to remain low in the first quarter of the year, before steadily increasing through the third quarter and finally sloping down again in the final quarter of 2023.

Home sales are steadily increasing and are expected to remain on the rise in 2023. The luxury market has decreased its pace but is likely to pick back up next year. The average residential sale price in Calgary is anticipated to increase by seven per cent in 2023.

Edmonton, Alberta

Similar to the majority of regions across the country, Edmonton is currently experiencing a balanced market, with demand expected to increase in the spring. Move-up and move-over buyers are driving demand in the region and are expected to continue doing so into 2023. The average residential sale price increased by three per cent from $387,614 in 2021 (January-December) to $401,025 in 2022 (January-October). Single-detached homes remain the dominant housing type.

However, Edmonton is expected to weather the recession well, as average incomes in the region are some of the highest in the country, according to Carter. Despite rising interest rates, the majority of buyers have not capped their mortgage capacity. Demand for downtown condos is expected to continue rising in 2023, with demand in the luxury segment becoming more robust in the year ahead. The average residential sale price in Edmonton is anticipated to increase by three per cent in 2023.

Regina, Saskatchewan

Regina is considered a balanced market and is anticipated to remain one in 2023. Move-up and move-over buyers have driven demand in the region and are expected to continue doing so into 2023. The average residential sale price in the region decreased by one per cent from $324,650 in 2021 (January-December) to $320,970 in 2022 (January-October). Single-detached homes remain the dominant housing type in the region.

Rising interest rates will likely be a dominant theme in 2023, resulting in a slower market for both buyers and sellers. The average residential sale price in Regina is anticipated to remain the same in 2023.

Winnipeg, Manitoba

Winnipeg is currently sitting in a balanced market, but is expected to shift to a buyer’s market early in the year before returning to balance in late 2023. Move-up and move-over buyers continue to drive demand in the region, with single-detached homes remaining the dominant housing type in the region – trends that are both expected to intensify in 2023. The average residential sale price increased by 10 per cent from $386,491 in 2021 (January-December) to $423,680 in 2022 (January-October).

Rising interest rates are expected to continue placing pressure on affordability and pre-approval amounts in Winnipeg next year. Unlike the majority of regions, Winnipeg is experiencing an increase in joint family and multi-generational family ownership – which can be attributed to ongoing affordability challenges. The condo market is in line with the changes experienced in the overall market. The average residential sale price in Winnipeg is expected to decrease by 8.5 per cent in 2023.

Ottawa, Ontario

Ottawa is currently defined as a seller’s market and it is anticipated to remain one into the third quarter of 2023, where subsequently it is anticipated to become balanced. First-time homebuyers are driving demand in the region due to its relative affordability a trend that is expected to carry on next year. The average residential sale price increased by nine per cent from $601,039 in 2021 (January-December) to $656,761 in 2022 (January-October). Townhomes are currently the most in-demand housing-type due to the accessible entry-point they provide buyers.

First-time buyers in Ottawa are particular about the finishes, style and location of their homes, with many not wanting to spend money on small renovations. As single-family dwellings have become unaffordable to rent, multi-residential properties and tiny or coach home conversions are expected to increase. Rising interest rates are anticipated to continue cooling the market in the next year. Supply remains an issue in Ottawa, with many new construction developments being halted due to increased development fees and material and labour shortages. The average residential sale price in Ottawa is anticipated to increase by four per cent in 2023.

Montreal Region, Quebec

The Montreal Region is currently a seller’s market, but certain types of properties and areas will be going towards a balanced market. These conditions are anticipated to continue into 2023. Currently, move-up and move-over buyers are driving demand in the region – a trend expected to carry over next year. The average residential sale price increased by 13 per cent year-over-year in Montreal from $490,000 in 2021 (January-December) to $556,000 in 2022 (January-October). Single-detached homes are the most in-demand housing type in the Montreal Region.

Now in the post-pandemic, housing demand is beginning to balance back to pre-pandemic levels. Rising interest rates are anticipated to continue impacting the housing market in 2023 – specifically by reducing its pace. Supply chain, labour shortages and rising costs of materials and labour have caused new construction developments to become delayed. The luxury market is expected to continue to cool in 2023, thus creating more advantageous opportunities for potential buyers. The average residential sale price in the Montreal Region is anticipated to decrease by five per cent in 2023.

Halifax, NS

Move-up and move-over buyers are driving demand in the region and are expected to continue to do so next year. The city saw an 19 per cent increase in year-over-year residential sale prices from $457,741 in 2021 (January-December) to $542,663 in 2022 (January-October). Single-detached homes remain the most in-demand housing type among buyers. Interest rates rising and inter-provincial migration reducing post-pandemic, contributed to the number of sales in the region decreasing by 25 per cent year-over-year, from 6,588 in 2021 (January-December) to 4,912 in 2022 (January-October).

Supply is anticipated to remain tight in 2023 for Halifax, as buyer demand remains high and the city prepares to welcome a wave of new Canadians. Renting rooms and sharing expenses are ways first-time homebuyers are entering the market in Halifax. The luxury market has experienced additional activity and a recent rise in prices, but overall, this segment is expected to cool in 2023.

The average residential sale price in Halifax is anticipated to increase by eight per cent in 2023.

Additional findings from the 2023 Canadian Housing Market Outlook Report

- Western Canada

- In Nanaimo, BC, the Greater Vancouver Area, BC, Kelowna, BC and Winnipeg, MB average residential sale prices are expected to decline by five to 10 per cent in 2023.

- Victoria, BC, Calgary, AB, Edmonton, AB, and Saskatoon, SK are all expected to see average residential sale prices increase between two to seven per cent in 2023.

- The average residential sale price is not expected to fluctuate in Regina, SK in 2023.

- 67 per cent of regions in Western Canada are considered balanced markets, including Victoria, BC, GVA, BC, Calgary, AB, Edmonton, AB, Regina, SK and Winnipeg, MB.

- Nanaimo, BC and Kelowna, BC are both considered to be buyer’s markets, while Saskatoon, SK is categorized as a seller’s market for single-detached properties and a buyer’s market for condominiums.

- Ontario

- In London, Kitchener-Waterloo, Barrie, the GTA, Durham, and Lakelands West (Georgian Bay area) average residential sale prices are expected to decline by two to 15 per cent in 2023.

- Sudbury, Hamilton-Burlington, Oakville, Brampton, Ottawa, Mississauga, Muskoka, Niagara, Windsor, York Region, Haliburton, Peterborough and The Kawarthas, and Kingston are all expected to see average residential sale prices increase between two to eight per cent in 2023.

- 40 per cent of regions in Ontario Canada are considered balanced markets, including London, Kitchener-Waterloo, Oakville, Barrie, Toronto, Windsor, Lakelands West and Kingston.

- Hamilton-Burlington, Brampton, Mississauga and Niagara are all considered buyer’s markets, while Sudbury, Muskoka, Durham York Region, Haliburton, Ottawa and Peterborough and the Kawarthas favour sellers.

- Quebec

- In Quebec City, average residential sale prices are expected to decline by 10 per cent respectively.

- The region of Montreal is a seller’s market, while Quebec City is a balanced market.

- Atlantic Canada

- In Moncton, NB, Saint John, NB and Fredericton, NB, average residential sale prices are expected to decline between 3.5 and five per cent in 2023.

- Halifax, NS and St. John’s, NL are both expected to see average residential sale price increases in 2023, rising eight and four per cent respectively, while sale prices are anticipated to remain unchanged in Charlottetown, PEI.

- With the exception of St. John’s, NL (a balanced market), all regions in Atlantic Canada are considered to favour sellers.

Additional key insights from the Leger survey:

- Although rising interest rates have cooled/stabilized the real estate market, 45 per cent of Canadians are concerned that further increases will impact their ability to engage in the real estate market in 2023

- 54 per cent of Canadians believe that the two-year ban on foreign investors purchasing property which will come into effect on Jan. 1, will increase the availability of affordable housing for local homebuyers

- 15 per cent of Canadians are considering moving to another province in 2023 to find better housing affordability and liveability

- 54 per cent of Canadians feel confident that their financial situation will remain steady in 2023

Source: RE/MAX

“On Wednesday, June 7th, the Bank of Canada announced it was increasing interest rates by another 0.25%. The last 15 months saw the Bank of Canada rapidly increase its policy rate from 0.25% in March 2022 to the current level of 4.75%. However, Wednesday’s announcement carries one of the biggest punches that might impact the stability of a real estate market that has started to show signs of recovery.

After eight increases over the past 15 months, you would think Canadians would be sensitized and at peace with the pattern of raising rates to squash inflation, however, it’s also the first time that Canada’s central bank has raised its trend-setting interest rate since January 2023, when the bank signaled it would conditionally pause its rate hikes to wait and see if it had done enough to bring down inflation.

FOMO’s back…for a minute

Shortly after the January pause was announced, buyers who were waiting for more than a year on the sidelines, took the opportunity to jump back into the market. After more than a year of pent-up demand, full out FOMO ensued.

National home sales surged 11.3% month-over-month in April. In May, Toronto’s Real Estate board reported a 24.7 percent increase compared to May 2022. For the first time in months, prices started appreciating in key markets. In Toronto, Low-rise home prices were up $200K since January and up 2% over last year. Multiple offers and bidding wars were back in style, across major markets. You can clearly see the impact of this surge of activity on home prices across the country in the graph below, which covers the Home Price Index (HPI). For the first time in more than a year and after a significant decline, prices ticked up again.

It’s easy to explain the surge in the market we’ve seen in the last couple of months. January’s pause gave most buyers and investors hope that they were signing up for the highest interest rates they’ll ever see. It also came after months of price declines and all indicators were that the market has pretty much hit bottom and that price decreases will pretty soon reverse course. That meant that the time to buy was – now!

Marry the house, date the rate

Most buyers in February through May also signed up for a narrative that the Bank of Canada will not raise rates any further. They made a bet that if they will buy now – at the highest possible interest rate, interest rates can’t go anywhere but lower (does the cliche term “marry the house, date the rate, ring a bell?).

In essence buyers bought into that narrative. They married the house. But dating the bank of Canada, who has previously proven that its decisions and policies can shift on a dime, may not always work out. For those buyers who took the BoC’s word and decided to buy now, absorb the pain of higher rates, and eventually refinance when rates go down, it may have turned out to be one bad “date”.

After the rate hikes this week, “marry the house, date the rate” no longer holds up. At least in the short term, which buyers were banking on. The BoC came out swinging and indicated it was clearly not done raising rates, and if anything it may be a long time until rates start going down. The bank’s latest move to increase its target for the overnight rate from 4.5 per cent to 4.75 per cent takes the bank’s benchmark to its highest level since 2001. The market has priced in further increases, as early as next month and bond yields, which impact fixed rate mortgages, went wild and increased by at much as 40 basis points so far.

Where does that leave would-be buyers? The 25 basic points increase this week, isn’t what’s relevant. It’s by no means an insignificant amount, but that’s not what matters here. What matters is that consumer confidence has been shattered as the narrative that most were willing to transact under, is no longer true. This puts buyers back into a “wait-and-see” pattern until they feel stability again, which may be a while. In fact, according to BMO’s research, of Gen Z homebuyers (ages 18 to 24), 71% say they’ll defer their home purchase until rates are lower, while 69% of younger Millennials (ages 25 to 34) say the same. But wait…there’s more.

The chicken-and-egg game

It’s easy to read this post and others and point right at the Bank of Canada as the party to blame.

Does the BoC really want to see Canadians lose their home? Is inflation ever really going down or are high prices already “baked” into our system and are nearly impossible to reverse course on?

The reality is that despite the January “pause”, the BoC has been crystal clear on their plans. They will continue to raise interest rates until inflation is under control. We may not agree with it, but that’s their mandate and what they signed up for. In April, after months of seeing positive signs of inflation coming down, Canada’s annual inflation rate unexpectedly rose again (from a March figure of 4.3% to 4.4% last month)

Now here’s the kicker. The primary reason for inflation rising in April were the surging costs associated with holding a mortgage and renting a home. Mortgage interest costs ballooned by a huge 28.5% last month from the same time last year. If you’re a renter, what happens when mortgages go up? Your rent goes up. Year-over-year rental costs spiked by 6.1% and accelerating over the previous month.

So if you’re following so far, what you’re seeing is a chicken-and-egg scenario unfold.

- The BoC raises interest rates to reduce inflation

- Those same higher interest rates impact mortgages, which therefore also cascade to renters (because their landlord likely has a mortgage)

- The higher cost of mortgage and rent payments causes even more inflation

- The BoC reacts by repeating step 1

Reality is, it’s a vicious cycle and the BoC knows it, however, as the central bank with a mandate to keep inflation under control, interest rates are the only economic mechanism they have at their disposal to keep inflation under control.

The bottom line – What does it all mean

We’re not out of the woods by any means when it comes to stability in the Real Estate market. While there were clear early signs of recovery, the June 7th interest rate hike was merely a symbolic one, but made the message very clear. The Bank of Canada is not done yet. This puts buyers and sellers in a funny spot again, where consumer uncertainty rules the day, and when it comes to a free market economy, that’s not a good place to be in.

Important note: This article is not Legal Advice. No one should act, or refrain from acting, based solely upon the materials provided on this website, any hypertext links or other general information without first seeking appropriate legal or other professional advice.”

https://deeded.ca/2023/06/10/boc-june-increase-real-estate-market/

Get outside and enjoy the sunshine.

After spending more time at home than ever before, most of us are eager to get outside and enjoy the sunshine this spring. But, unless you’ve been carefully tending to your yard, there’s a good chance those outdoor spaces could use some TLC.

As it turns out, the key to creating a truly relaxing backyard oasis lies in delighting the five senses, and nearly any homeowner can partake. From the smell of jasmine to the soft glow of string lights, here’s how to level up your backyard this spring.

Prioritize privacy

Of course, you can’t truly relax when the neighbours are too close for comfort. Before tackling anything else, make a point to establish some privacy.

You may not want an extra-tall privacy fence all along with the property, but creating even just a few closed-off nooks promotes relaxation. Consider curtains, climbing plants, trellises, hedges, planters, and more (Better Homes and Gardens, 2021) to section off your space, prevent prying eyes and create a perfectly calm environment. Goodbye, looky-loos!

Set up seating

No outdoor space is complete without a functional seating area. Outdoor daybeds invite lounging, while a picnic table would be perfect for entertaining.

If you’re feeling creative, don’t shy away from swings, hammocks and other unique options, either. Whatever your taste, just ensure plenty of comfortable seating is well within reach.

Tend to the garden

Greenery can make or break an outdoor space. In fact, plants have been shown to have a therapeutic effect, promoting feelings of calmness and cutting down on stress (Forbes, 2020). For added fun, incorporate plants with sweet-smelling flowers, vibrant colours or unique shapes.

Let there be light

While lighting may initially seem a bit insignificant, when used correctly, it can truly transform a space. For example, warm light is often seen as calming and inviting, while cool light feels more invigorating.

Consider hanging string lights over the seating area to add ambiance, or place torches throughout the yard if lawn games are on the agenda. Either way, good lighting (Country Living 2021) ensures your outdoor oasis is fully functional, even after dark.

Install a water feature

Did you know that the sound of running water (Smithsonian, 2021) can actually boost health outcomes and promote feelings of tranquillity? Unless you’re lucky enough to live right on the beach, you may need to do some legwork to incorporate this element of relaxation.

Installations can be as simple as a birdbath or as complex as a full-on fountain. Whatever your preference, a water feature is sure to make a splash in your backyard oasis.

Consider a sound system

If running water isn’t quite cutting it, a soothing playlist might. Pick up a simple Bluetooth speaker or invest in an outdoor speaker system (HGTV). Then, take a note from your favourite day spa and put on something soft and soothing.

Imagine yourself lounging in a hammock under bistro lights, flowering perennials nearby… Now, grab a shovel and make it a reality! Your backyard oasis is waiting.